Tax Reform and Lies

I had a curious chat with a friend yesterday. He is in his

early 50s and the story he relayed to me referenced his father, presumably

retired in his 70s or 80s. With passion my friend conveyed the lessons of his

youth, which flourished with impassioned equality for all races and religions.

With great lament, he also shared how his father has changed over the years. He

switched teams and is now an R instead of a D. Even as a scientist, his father

no longer acknowledges the particulate matter that industry has deposited in

our atmosphere to create a greenhouse effect and contribute to global warming.

“Your dad was successful,” I commented. “Taxes have a way of

changing a man.”

“Yes,” he replied. “And now I am beginning to see the tears

in the fabric of my long held beliefs,” he added.

If you are a friend that follows this blog, you know that I

party with the Democrats on social issues, and party with the Republicans on

fiscal issues. I am an independent because I think we desperately need a third

party in our nation that gives me a voting platform. Like so many others, I

hated both options in the last election.

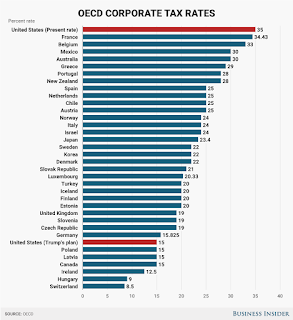

The Tax Burden to

American Businesses is the highest in the world.

You will hear this again, and again, and again as President Trump

opens the door to tax reform. He is accurate. According to the OECD, the United

States taxes corporations at 35%. But the data is a bit misleading because we

have a complicated tax code with deductions. After deductions, our tax rate is

the 4th highest in the world, falling in behind Argentina, Japan,

and the United Kingdom. The United Kingdom charges 19% but does not have the

deductions. Other taxes like sales tax, VAT, and State Taxes are not included

in this calculus. Trump is recommending 15% tax rate but has not discussed

deductions.

Liars figure and

figures lie

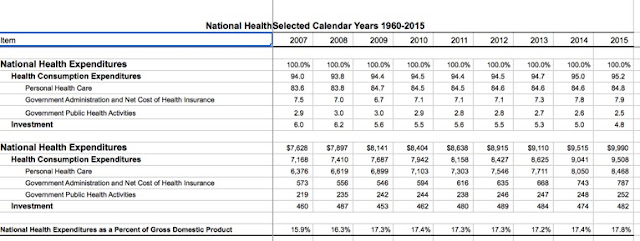

There is an ugly truth behind all of this data. It’s shaped

by politics. If I wanted to combat Trump’s position, I would indicate that as a

percentage of

Gross Domestic Product or GDP, net of taxes – the United States

ranks 32 among developed nations with an effective tax rate of 26% of GDP. By

this measure, the tax rate in the United States is super low. Notice how the

countries in each list are different. Notice how India and China are not on

this list?

Our retirement will

suck

I feel deeply for my friend. To watch a father become

overwhelmed by taxes, low yield on savings, and rapidly escalating health care

costs is real. When you are retired, the more you have the more they take. Retirement

is a personal tax issue, unless you have investments on your savings. When you

see profitable companies write a check to the federal government for 35% of the

profit before paying dividends, it hurts. If you take the approach of many

retirees who have low risk portfolios, interest on cash and bonds is less than

inflation. Just holding your money generates losses in value. As for healthcare

– it’s free to those who have no assets and more than the cost of a mortgage

for those who have been saving their whole lives.

I understand his father’s curmudgeonous view of the world.

He probably worked 10-hour days his whole life. He probably sacrificed life’s

indulgences he earned for the safety and security of savings in retirement,

only to see more and more of his savings taken from him because of his success.

America has lost its sense of equal opportunity. We are not

all equal under the tax law or the health care law. Some get more than they

give and others give more than they get.

My Utopian Tax Code

As for me, I would love to see the removal of all corporate

taxes. The government could set a threshold of reserves – say 6 months

operating expenses. After that, corporations must distribute all profits to shareholders

or employees. That goes for State taxes on corporations, which are not even

discussed by the OECD. All income should be taxed at an individual level and it

should be equal for all citizens (FLAT TAX) regardless of how much you make.

Remove all personal deductions too. Remove cash. All money should be electronic

to remove the incentives to cheat. Illicit business would need to transact in

goods or services rather than money. Lets see you buy your next dose of heroin

with a used set of golf clubs or your favorite chair. All healthcare should be

priced the same too – one price for every citizen.

It’s too bad that my friend’s dad has lost his liberal

spirit. I wonder if he would agree with my thesis for utopia?

Comments

Post a Comment

Thanks a lot for leaving a comment. My phone number is 805-709-6696 if you have any questions.